Prepare for financial risks

woman using a laptop while sitting at a table

View your current retirement outlook with My Interactive Retirement PlannerSM and contact a Retirement Specialist to discuss your plan for financial risks.

Log in

You may think of retirement as a time to enjoy life, but you may not realize it can also be a time of uncertainty and risk. Unpredictable factors such as stock-market performance, inflation, interest-rate fluctuations and even how long you’ll live can impact your retirement plans.

Preparing for the unexpected will help you handle future surprises. That’s especially important because over the course of a 20- or 30-year retirement, economic conditions can change significantly and without warning. Here are four key risks to be aware of and ways you can plan for them.

Market risk

No one can predict how the stock market will perform at any given time. While stocks have historically outperformed other investment types over the long-term, market volatility can affect the value of your portfolio. If steep losses occur during your retirement, it can potentially result in less income.

To guard against market risk, you might want to spread investments across a wide range of options. That way, if some investments aren’t faring well, others may be doing better. Consider these strategies:

-

Asset allocation — Divide investments among different asset types, such as stocks and bonds

-

Diversification — Spread your assets across a variety of investments within each type, such as stocks of different-sized companies in different industries and countries

-

Diversified asset allocation — Combine the two approaches into a single strategy that spreads your investments across a wide variety of assets.

You may be invested in funds through your retirement plan that take care of asset allocation and diversification for you. Check your account online for your current asset allocation and investments. Also, remember not to let emotions rule your investment decisions. Pick an investment strategy and stay focused on your long-term goals.

(Note: Asset allocation and diversification do not assure a profit or guarantee against loss in a declining market.)

Inflation risk

Inflation means there is a general increase in prices so that you can’t buy as much with the same amount of money. Since inflation typically occurs each year, you will likely pay more to maintain your standard of living in the later years of retirement than in the early ones. For example, an item costing $100 30 years ago would cost about $200 today.

To account for inflation, you might consider:

- Increasing contributions to your retirement plan regularly throughout your career to help build your savings and earnings

- Having some investments that tend to keep pace with inflation better, like stocks

- Withdrawing less money earlier in retirement so more money remains invested with more time to grow

Also, when planning your retirement income, consider maximizing other sources you may have, such as Social Security and pension benefits. For instance, Social Security makes yearly cost-of-living adjustments to help make up for inflation. Waiting longer to claim your retirement benefit can give you a larger monthly amount, which will lead to bigger raises down the road.

Interest-rate risk

Interest rates rise and fall as economic conditions change. No matter what they're doing today, there’s no telling where they’ll be in 5, 10 or even 20 years. Regardless of which direction they move, interest rates can affect your finances in retirement.

- Falling rates can reduce interest from investments such as bonds and certificates of deposit, potentially decreasing your income in retirement

- Rising rates can hurt the stock market's performance, which could lower your portfolio’s value so it generates less income

- Rising rates tend to decrease the value of bonds, potentially hurting your bottom line if your portfolio contains them; falling rates tend to do the opposite

As discussed above, a diverse investment mix can help protect you. You might include investments in industries that tend to do well despite rising interest rates. You may also invest in funds that have a variety of bonds, such as short-term, domestic and international bonds, to help minimize the risk from any single type of bond.

Longevity risk

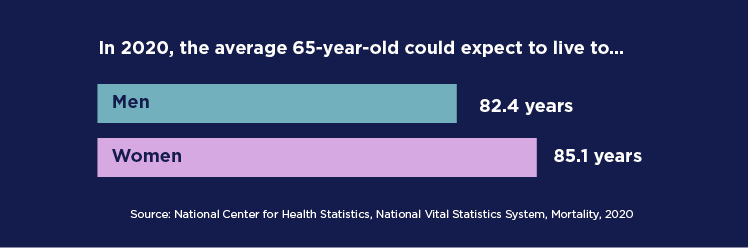

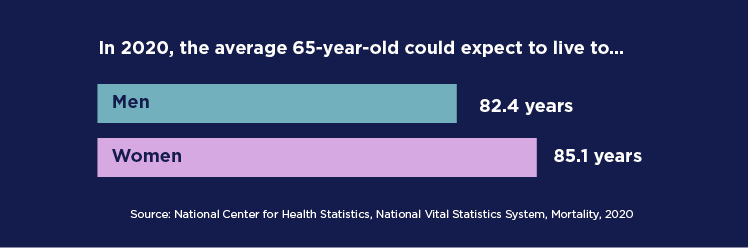

People today live longer — and many retire earlier — than people in past generations did. In fact, your retirement may last decades. While that may be a good thing, it also means you could outlive your savings, commonly known as longevity risk.

You can reduce longevity risk with careful planning. Consider:

- Your life expectancy and when you plan to retire so you can estimate how much savings you’ll need

- How and when to access your Social Security and pension benefits, if you have them, to maximize your retirement income

- Continuing to invest in some higher-risk assets like stocks; that comes with more risk but can also create greater returns and help your portfolio last longer

- Relying on a withdrawal strategy to guide how you take out your retirement savings, which can keep you from outliving your funds

You can't avoid risks, but you can plan for them.

Thinking ahead can help you prepare for whatever comes your way. Contact a Retirement Specialist to learn more.