Social Security 101

What does Social Security provide?

Will Social Security provide all the income I need in retirement?

How is Social Security calculated?

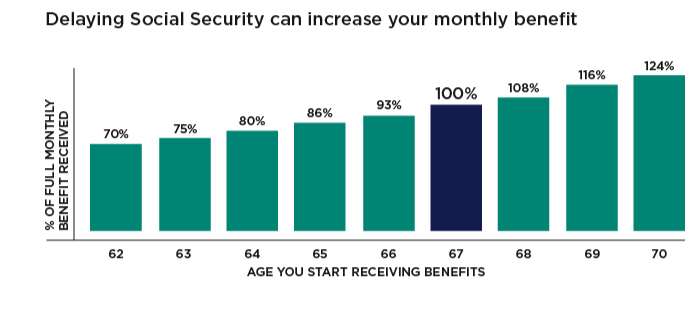

When can you file for Social Security?

What is the best age to start receiving Social Security?

Start planning your retirement income today

See your current projected retirement outlook with My Income & Retirement Planner®.

See your current projected retirement outlook with My Income & Retirement Planner®.